A-Share: Straight Surge Hints Bull Market; Will Market Sail High in PM?

This morning, the A-shares market opened significantly lower and then fluctuated up and down. The three major indices showed a severe divergence. The A-shares market has been undergoing significant changes in recent days, which requires our high attention. Let's discuss whether the A-shares market can end its adjustment in the afternoon, return to the fluctuation range, and thus trigger a significant rebound.

Firstly, the A-shares market has been undergoing significant changes in recent days, which requires everyone's high attention.

1. The recent rebound of the A-shares market has been driven by the theme of foreign capital's explosive purchases and the appreciation of the Chinese yuan. This is the same as the hype and approach of the A-shares market after last year's Spring Festival. In reality, it is the northbound capital that is tossing back and forth. They first pull up the A50 futures index, and then the northbound capital is the first to take action in the A-shares market. The first to flee is still the northbound capital. We can see that the liquor stocks, which are the main focus of the northbound capital, also known as the "Mao Index," have already filled the gap of September 30th. Today, these stocks are still in a significant decline.

Advertisement

2. Stocks with heavy positions in social security and insurance funds have started to become active. This is mainly the trend of the banking sector, which is the opposite of the overall A-shares market. Today, the bank index once again rose by nearly 2%, and the real estate sector increased by more than 4%. However, the A-shares market still opened with a 1% decline and was quickly pulled up by bank stocks. After filling the morning gap, the A-shares market experienced a rapid decline.

At 10:40 AM, the major forces activated the large indicator stocks in the oil sector to lift the index. Seeing that it was not working, they once again used the securities index to fight, which finally turned the A-shares market red. After 11 AM, the main forces began to concentrate on lifting the securities index, with the increase expanding to 2.51%. There was a momentum of going all-in, trying to reactivate the market again, but the effect was minimal because the trading volume did not increase synchronously, and there was no follow-up capital.

3. In fact, I think old fans and friends are not unfamiliar with the current trend of the A-shares market. The major forces are fighting each other, just like before September, and have returned to the pattern of that time.

I often tell everyone that the northbound capital is the right hand of the main force, and the stocks with heavy positions in social security and insurance funds are the left hand of the main force. Today's trend is to lift the left hand's banks and oil to cover the "Mao Index" and "Ning Portfolio" of the northbound capital. It is still a situation of fighting each other, and it has already deviated from the previous state of significant lifting. It has returned to the normal trend of the A-shares market, which is the main force playing by itself.Due to the breakdown of Guizhou Moutai today, and the sharp decline of Contemporary Amperex Technology Co. Limited (CATL) by more than 2%, today's A50 futures have essentially broken through the support level. This includes the A-share market index, which has also broken through. The market opened directly below 3167 points this morning, and breaking below 3200 points is considered a breakdown. This is basically in line with my forecast from yesterday. After breaking through 3200 points, a rebound is expected, with the lowest point being between 3150 and 3180 points. Today's morning session saw the A-share market index enter this range, followed by a rebound.

Additionally, the A-share market has now returned to an era where the major players are dancing alone, with each side fighting each other, which is essentially mutual cover and mutual unloading. Why not? The banking index has already been on the rise for 10 years, and sectors like oil and coal have seen significant increases in the past, with substantial gains. They can be sold at lower positions, so why not sell at 3200 points?

Secondly, I maintain my judgment of the A-share market from yesterday, which is that today will see a trend of falling first and then rising.

My forecast from yesterday was: I personally believe it will enter the range of 3180-3150 points. If it enters this range, the A-share market will rebound and quickly recover 3200 points, because to unload, one needs to manipulate the market. Only by manipulating the market can one attract buyers and create the illusion that the market cannot fall further.

Here are some additional points I would like to make:

Firstly, today's pull-up of the securities index is akin to forcing ducks to climb onto a shelf. It is done to manipulate the market and continue to lure more buyers, as the short-term adjustment of this index is far from being in place. Today, it was out of necessity that the securities index was lifted.

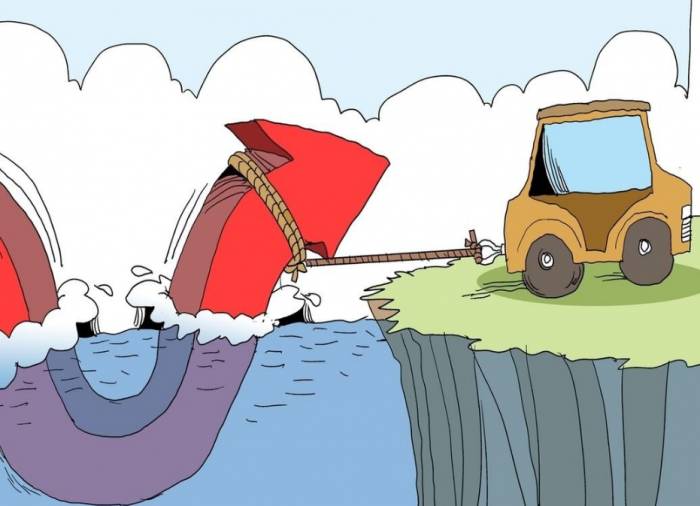

Secondly, as clearly stated in yesterday's article, as long as banks rise, a large number of individual stocks will fall. This was the case in today's morning session. The attempt to fight on both sides while also maintaining the market's stability has turned banks and oil into contrary market indicators. Fighting on both sides is essentially unloading, but this tactic has now been overplayed by the major players themselves, leading to a situation where retail investors are keeping their distance.A while ago, the market was manipulated to reach 2,685 points. Now, as the tide recedes, we can see who was swimming naked. It turns out to be just as expected. Without a bit of excitement, the market would be too difficult to play with. After the excitement, the game continues, and today there's a feeling that the game is becoming unplayable. Reluctantly, the money-counting flag bearer is brought out again to perform a straight-line lift, all to lure more buyers.

Thirdly, pay attention to today's rebound, as it could very well be the last rebound before the A-share market breaks below 3,200 points. This requires everyone's close attention, with more observation and less action.

As mentioned earlier, the Mao Index has broken through support levels, and the A50 futures have also broken through. These are leading indicators. It's only a matter of time before the A-share market breaks below 3,200 points. Currently, trading volume is shrinking day by day. Without the support of trading volume, playing with empty pulls on the index is just a way to push prices higher for distribution.

Leave A Comment